Would You Love To See Your Kids Get Wealthy... Or Struggle In Their 40s To Pay Off Credit Cards?

Your child, now grown, is standing in line at the grocery store.

Their cart is full of basic necessities.

As they swipe their card, their heart races. Will it go through?

Or will they feel embarrassed when it’s declined and they scramble to try a different one?

This isn’t just a one-time worry... it’s their everyday reality.

Every purchase feels like a gamble.

Every swipe brings the same question: "Is this the one that maxes out my card?"

They're stuck, working hard but never getting ahead, because most of their money goes straight to paying off debt.

And with so many stressors, you just hope they give you grandkids because the clock keeps ticking!

This isn't the life you dreamed for them...

Right now, most Americans don't have $1,000 saved for an emergency...

And most don't even have a retirement account!

Why?

Because they're drowning in credit card debt, always behind, always struggling to catch up.

It's nearly impossible to build a future when you're always paying for the past.

But it doesn't have to be this way...

Let's make sure your kids learn the habits and skills to stay out of debt, save money, and build the life they deserve.

One where they have a large nest egg for a retirement that's filled with adventure...

And not forcing a smile as a Wal-Mart Greeter in their 60s and 70s just to make ends meet.

A future where maybe they're even taking care of you... because you helped them get wealthy.

The real problem is that schools aren't teaching our kids how to save and plan for the future.

Sure, they’re taught math, history, and science…

But no one shows them how to:

- save and manage money

- set financial goals

- or build habits that lead to long-term success

It seems like something's missing, right?

We Can TEACH Them!

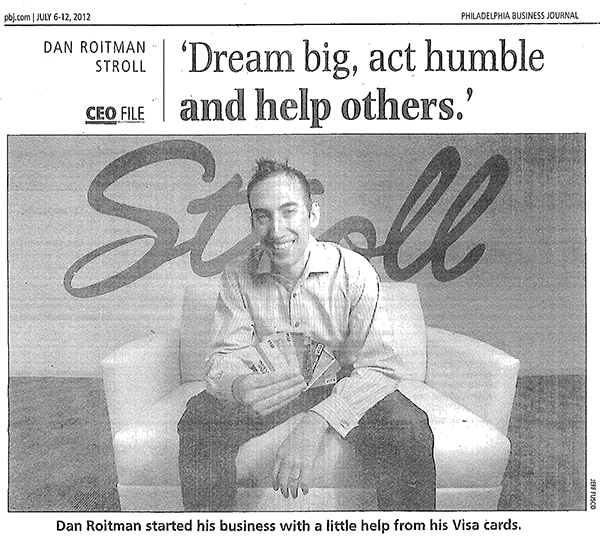

Growing up, my parents didn’t live paycheck to paycheck...

But like most families, we didn’t talk much about money or how to manage it wisely.

In college, I needed funds and kind of stumbled into good financial habits...

I worked 20 hours a week and saved diligently while studying, which helped me to build credit.

That credit gave me the ability to take a huge risk my senior year in college—launching my first company.

I’ll be honest: I ended up moving back in with my parents after graduating to keep working on my idea. I lived with them for three years while racking up $70,000 in credit card debt!

It was super risky... something that most people aren’t willing to do, and totally irresponsible unless you’re young or able to recover from failure.

Fortunately, I beat the odds and went on to build a $100 million company...

But it was the savings habit I built that put me in a position to take that leap.

Without that foundation, I wouldn’t have had the means or confidence to succeed.

After becoming a dad, and not finding anything inspiring on the topic, I decided to write fun and engaging stories for my own kids.

I want them to be go-getters, smart with money and to have practical life skills so they can succeed in any dream they pursue.

Introducing The Miller Moguls

What if your kids could learn how to:

- understand money in a way that sets them up for life

- delay gratification

- and save their first $1,000

…all while reading a fun, entertaining story?

That's exactly the promise of Rags to Riches...

It gives 8- to 13-year olds timeless financial principles they won't learn in school!

But this wisdom goes deeper than just money and savings...

It's about teaching your kids how to use wealth as a tool to help others and build a life of purpose.

Some of us like to call this "Good Wealth."

As parents, we all want to give our kids the best start in life.

But if you're not sure how to teach them about money or building wealth, that’s okay...

This story lets you do it together.

Who knows? By learning these principles, you might even strengthen your bond with your kids...

And maybe one day, they'll be the ones taking care of you!

A Fun Way To Learn About Money

Your family will join the three Miller kids as they lose their allowance and have to figure out how to make their own money...

They'll laugh while learning how to:

- Create financial goals

- Develop resilience

- Discover what success feels like

It’s pure entertainment with life-changing lessons woven into every chapter.

From Saving to Success

Imagine your kids saving their first $1,000... and feeling proud of their accomplishment.

Imagine them learning how to plan ahead, manage money, and build strong habits that will carry over into every area of their lives.

Whether they want to get a great job, start a business, or simply feel financially secure, these lessons will give them the confidence and know-how to succeed.

Your kids will start spotting opportunities, creating value, and understanding money...

They'll know how to earn it, save it, and make it work for them.

It's Time For A New Adventure!

Rags to Riches isn't just a fun read... it’s a tool to help your kids become confident, financially savvy, and prepared for the future.

Give your children the gift of financial independence.

Let’s inspire the next generation to dream big, save smart, and make a difference.

Take the next step and click the Learn More button below...